Tax Brackets 2025 California Married. The progressive nature of california income tax means that the more you earn, the higher your rate of tax will be. The deadline to file a california state tax return is april 15, 2025, which is also the deadline for federal tax returns.

There is also a 1.2% state disability insurance (sdi). 2% on taxable income between $9,326 and $22,107

2025 California Tax Brackets Married Filing Jointly Amalea Blondell, Calculate your income tax, social security and pension deductions in seconds. Quickly figure your 2025 tax by entering your filing status and income.

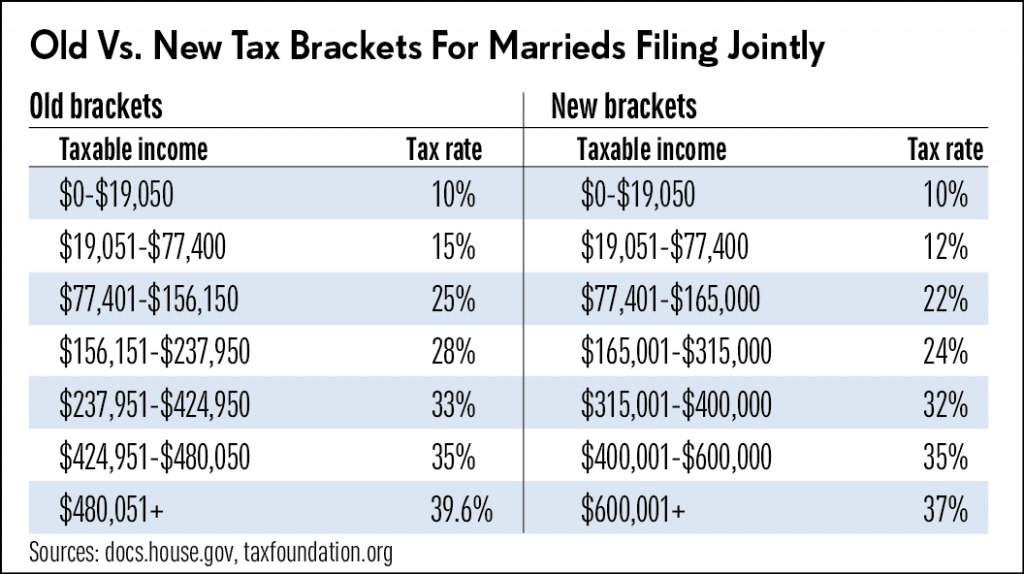

2025 Tax Brackets Married Myrle Laverna, This bill, for taxable years beginning on or after january 1, 2025, and before january 1, 2028, would revise the income tax rates and taxable income brackets by imposing an income tax rate of 4% instead of 6% or 8%, as applicable, on specified taxable income. The tax brackets are different for single and married filers but the percentage rates remain the same.

Tax Brackets 2025 Married Jointly Over 65 Elyse Imogene, For help estimating your annual income taxes, use aarp’s tax calculator. Calculate your income tax, social security and pension deductions in seconds.

2025 Tax Brackets Married Jointly Single Cherye Juliann, California will begin to levy the nation’s first separate state excise tax of 11 percent on any retail sale of firearms, ammunition, or precursor part in the state. There are nine state income tax brackets in california.

Ca State Tax Rates 2025 PELAJARAN, This page has the latest california brackets and tax rates, plus a california income tax calculator. Note, the list of things not included, such as deductions, credits, deferred income, and specialty dividends, capital gains, or other income.

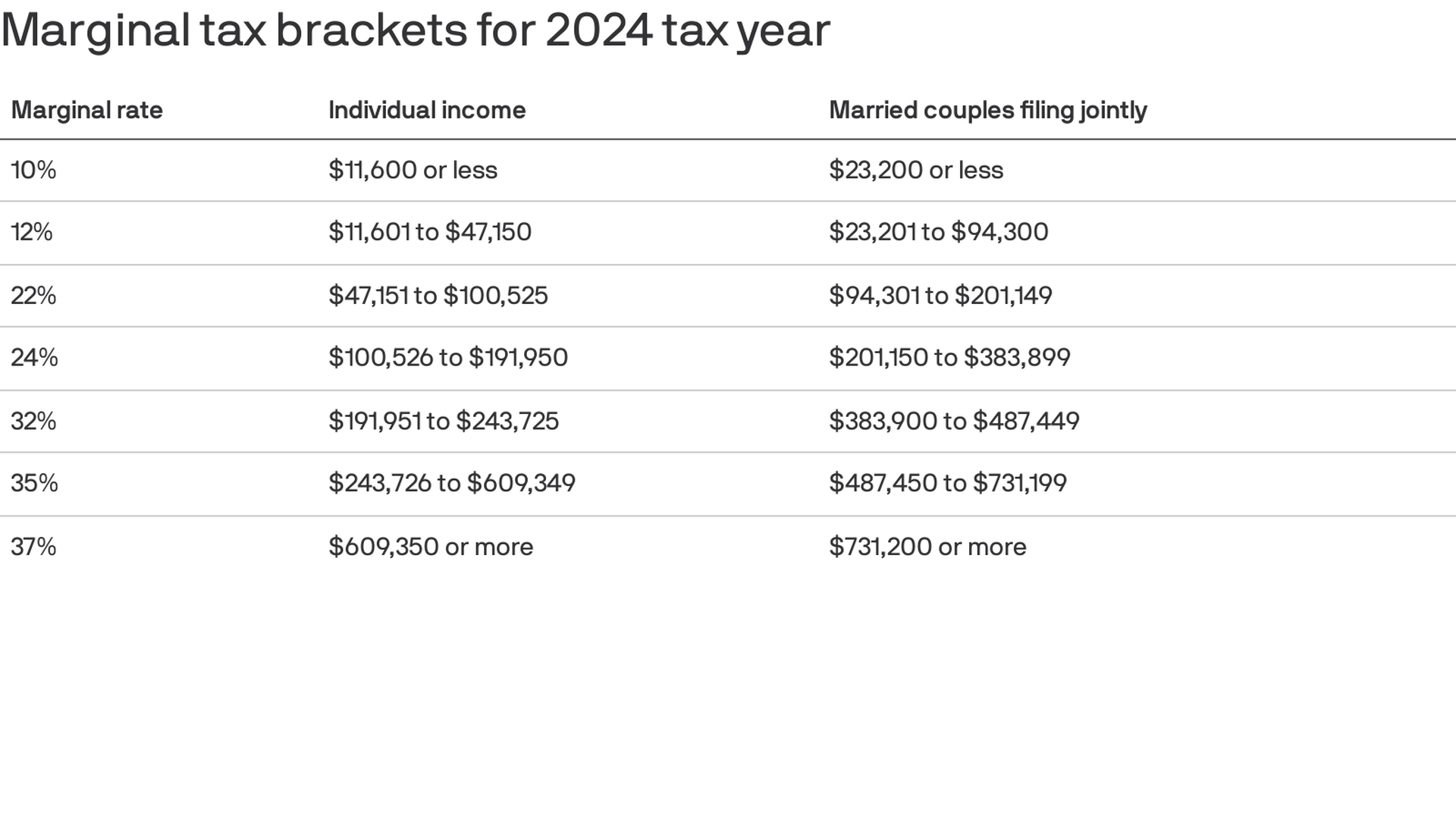

Federal Tax Revenue Brackets For 2025 And 2025, In all, there are nine official income tax brackets in california, with rates ranging from as low as 1% up to 12.3%. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Irs Tax Brackets 2025 Federal Ella Nikkie, Use our income tax calculator to estimate how much tax you might pay on your taxable income. California tax brackets for single and married filing separately (mfs) taxpayers.

2022 Tax Brackets Irs Married Filing Jointly dfackldu, For instance, the 37% tax rate now applies to individuals. This page has the latest california brackets and tax rates, plus a california income tax calculator.

2022 Tax Brackets Married Filing Jointly Calculator Latest News Update, One is the 0.9% additional medicare tax on earned income above $200,000 ($250,000 for married couples filing jointly). California tax changes effective july 1, 2025.

2018 Tax Rates Do You Know Your New Tax Bracket? — Freidel, Based on your annual taxable income and filing status, your tax bracket determines your federal tax rate. 1% on the first $9,325 of taxable income;

California uses a graduated, or progressive tax system, with nine brackets that apply to taxable income: