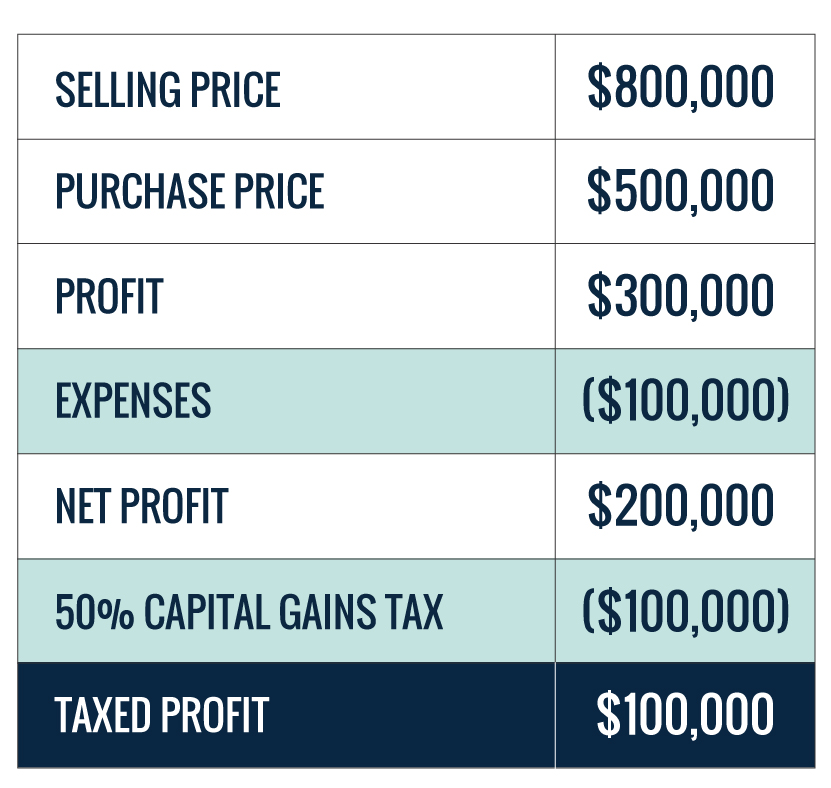

Capital Gains Tax Rate 2025 Real Estate. Real estate investors should pay close attention to the capital gains tax rates for 2025, as they directly impact the returns on their investments. For example, say you make.

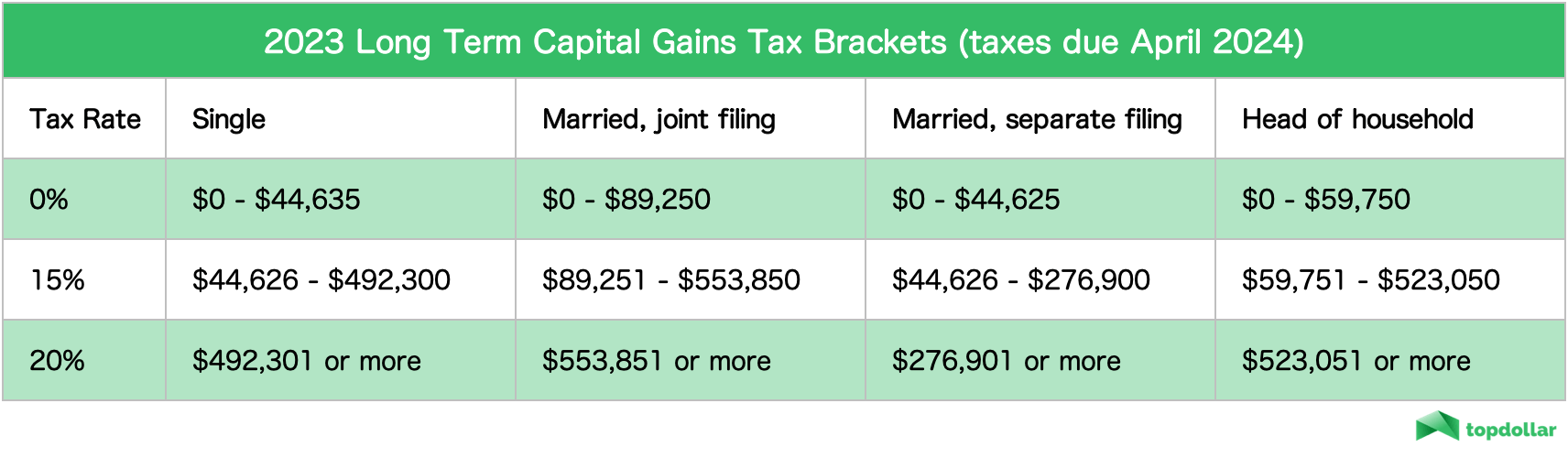

The capital gains tax is what you pay on an asset’s appreciation during the time that you owned it. Your income determines your capital gains tax rates.

Capital gains tax is the name for the tax levied on the profit of the sale.

As of today, the inclusion rate — the taxable percentage — goes from 50 to 66 per cent on capital gains above $250,000 per year for individuals, and on all capital.

Real Estate Capital Gain Tax Rate 2025 Ange Maggie, The rate goes up to 15 percent on capital gains if you make between. Several wealth managers said “lots of clients” had been in contact with questions about a possible cgt increase.

2025 Long Term Capital Gains Tax Rate Cassie Virgina, Capital gains tax rate 2025. In this article, you will learn how to calculate capital gains tax on real estate investment property.

Capital Gains Tax 2025 Budget Sher Ysabel, Capital gains tax is a levy imposed by the irs on the profits made from selling an investment or asset, including real estate. In 2025, single filers making less than $47,026 in taxable income, joint filers making less than $94,051, and heads of households making.

Capital Gains Tax Calculator 2025 Home Giulia Karleen, Several wealth managers said “lots of clients” had been in contact with questions about a possible cgt increase. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Capital Gains Rate 2025 Table Image to u, In this article, you will learn how to calculate capital gains tax on real estate investment property. Several wealth managers said “lots of clients” had been in contact with questions about a possible cgt increase.

Capital Gains Tax Brackets 2025 Devin Marilee, In 2025, single filers making less than $47,026 in taxable income, joint filers making less than $94,051, and heads of households making. Capital gains tax is the income tax you pay on gains from selling capital assets—including real estate.

ShortTerm Capital Gains Tax Rate 20252025 Overview, Income tax brackets are as follows: For the 2025 tax year, you won’t pay any capital gains tax if your total taxable income is $47,025 or less.

The Exciting World of Investment Property Taxes Toronto Real Estate, The capital gains tax is what you pay on an asset’s appreciation during the time that you owned it. Several wealth managers said “lots of clients” had been in contact with questions about a possible cgt increase.

Capital Gains Tax For 2025 Nonie Annabell, In this article, you will learn how to calculate capital gains tax on real estate investment property. The inflation adjustments impact real estate capital gains by adjusting the thresholds for tax brackets, potentially changing the rate at which an individual’s or entity’s capital.

Capital gains 2022 tax brackets hisasj, The 2025 federal budget proposes to increase the capital gains tax inclusion rate to 66.67%. For example, say you make.

At the most basic level, the taxable income comes from the difference between the original.